dallas county texas sales tax rate

Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. Welcome to the Dallas County Tax Office.

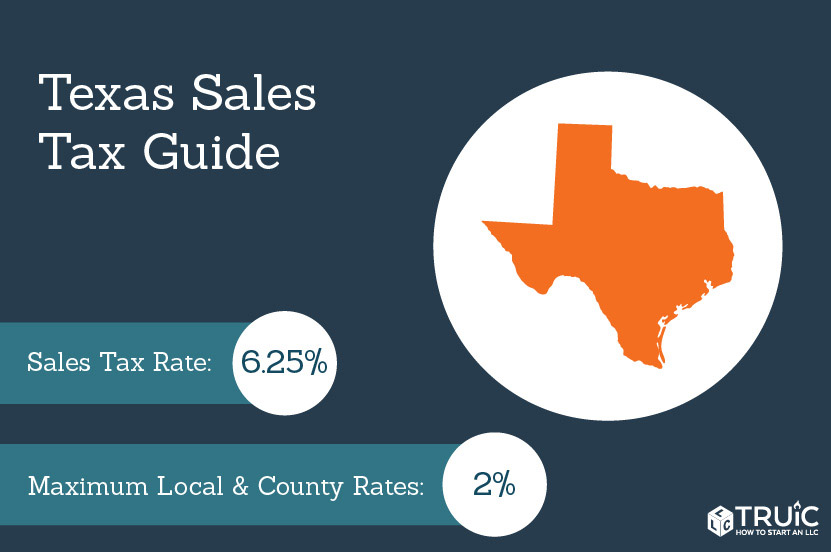

Texas Sales Tax Small Business Guide Truic

The Texas state sales tax rate is currently.

. 625 percent of sales price minus any trade-in allowance. 2022 Tax Rates Estimated 2021 Tax Rates. 214 653-7811 Fax.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. Name Local Code Local Rate Total Rate. 3717 S Central Expy Dallas TX 75215 is listed for sale for 219990.

The tax is collected by the retailer at the point of sale and forwarded to the Texas Comptroller on a monthly or quarterly basis. 3 rows Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas. Its county seat is Dallas which is also the third-largest city in Texas and the ninth-largest city in the United States.

As of the 2010 census the population was 2368139. 4 rows Dallas. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate AustinETravis Gateway Lib Dist Travis Co 6227668 010000 082500 Barclay 067500 AustinMTA 3227999 010000 FallsCo 4073002 005000.

15 county tax rate. Texas has state sales. TEXAS SALES AND USE TAX RATES January 2022.

Records Public Branch Garland and South Dallas. To review the rules in Texas visit our state-by-state guide. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of.

The current total local sales tax rate in Dallas TX is. Automating sales tax compliance can help your business keep compliant with. While many counties do levy a countywide.

3 County has a county-wide SPD sales and use tax and an SPD sales and use tax in part of the county. 2 SPD sales and use tax in part of the county. The sales tax rate in Dallas is 825 percent of taxable goods or services sold within c ity limits.

TX Sales Tax Rate. Dallas County is a county located in the US. Has impacted many state nexus laws and sales tax collection requirements.

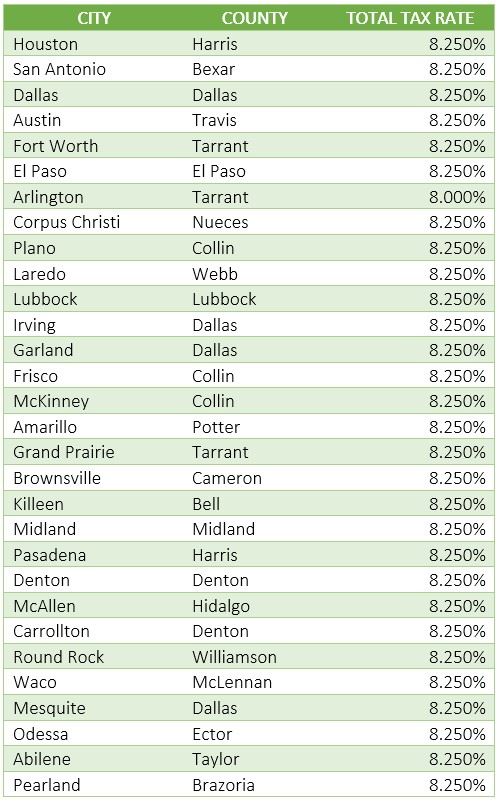

Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit our Texas sales tax calculator to lookup local rates by zip code. The total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1.

The Dallas County sales tax rate is. It is a 010 Acres Lot 1090 SQFT 3 Beds 2 Full Baths in Walkers. It is the second-most populous county in Texas and the ninth-most populous in the United States.

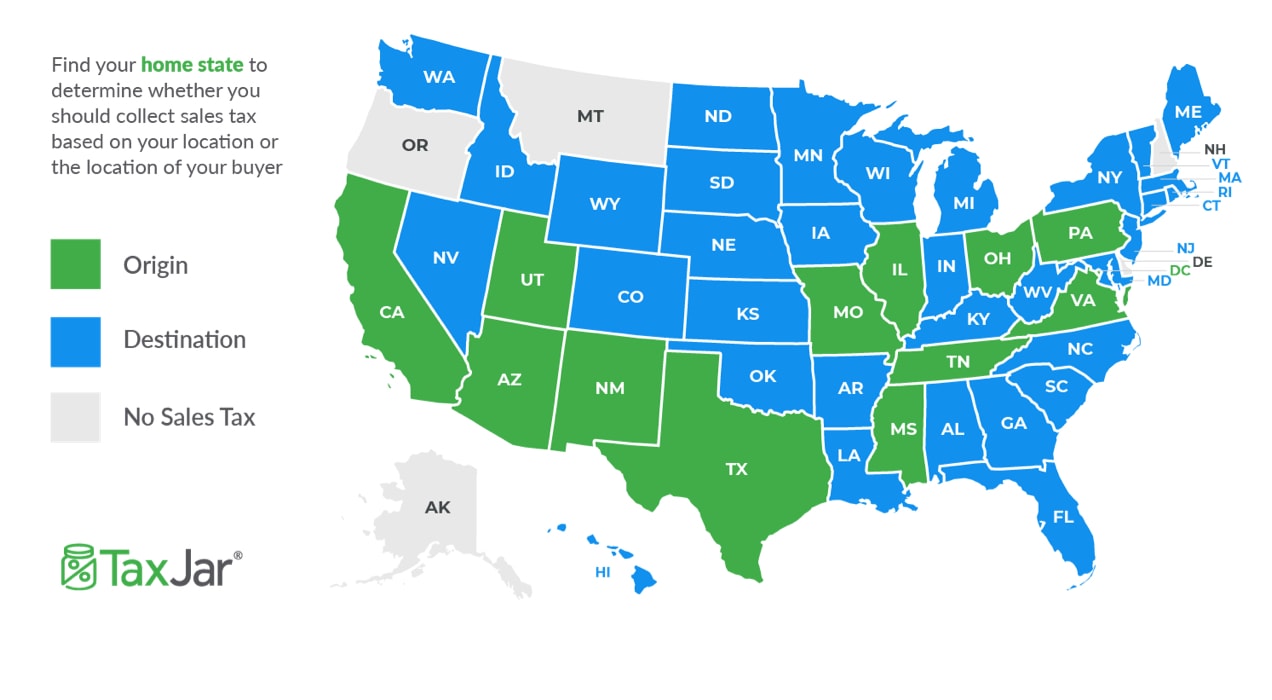

The Tax Office locations below are closed to the public on the following days. Dallas Texas sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Collin Denton Kaufman and Rockwall counties Texas and that a business must collect from their customers. The 2018 United States Supreme Court decision in South Dakota v.

Average Sales Tax With Local. 1 County-wide special purpose district SPD sales and use tax. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable. Notice of Tax Rates Form 50-212 Tax Rate and Budget Information Tax Code 2618 For more information related to Dallas County tax rates please visit the Dallas County Tax Office website.

If you need access to a database of all Texas local sales tax rates visit the sales tax data page. 214 653-7811 Fax. 2021 Tax Year Rates.

Records Building 500 Elm Street Suite 3300 Dallas TX 75202. 33 rows Dallas County Has No County-Level Sales Tax.

How To Charge Your Customers The Correct Sales Tax Rates

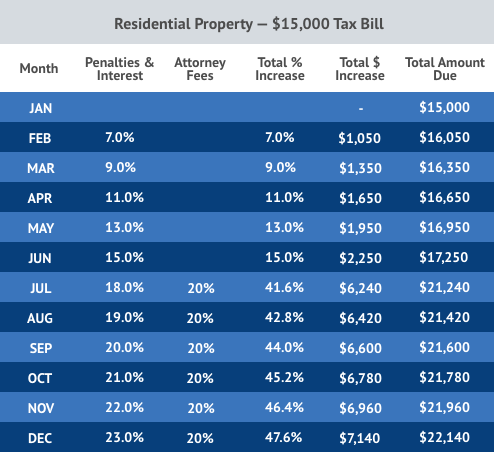

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Which Texas Mega City Has Adopted The Highest Property Tax Rate

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Texas Tax Group Inc Reviews Ratings Tax Services Near 4101 Mcewen Dallas Tx

Texas Sales Tax Rate Changes January 2019

How To Charge Your Customers The Correct Sales Tax Rates

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease

Tax Rates Richardson Economic Development Partnership

Texas Sales Tax Exemption Certificate From The Texas Human Rights Foundation Unt Digital Library

2021 2022 Tax Information Euless Tx

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Texas Sales Tax Guide For Businesses

Texas Sales Tax Guide And Calculator 2022 Taxjar

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Origin Based Sales Tax Example And Automated Sales Tax Collection With Tax Jar Sales Tax Tax Archer City

How To Charge Your Customers The Correct Sales Tax Rates

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key